The last month of the year has arrived and, as usual, outlooks have started to snow on what is to come: what will 2023 be like for the world economy and consequently for the financial markets?

To get an idea of the matter, it is naturally necessary to begin with the data acquired up until today. 2022 will go down the record as the year of high inflation and the equally powerful response from central banks, never so united and abundant in adopting a restrictive monetary policy for many decades now. The last few months are telling us that something on the price front is starting to move and, albeit at different speeds, all the main major economies are seeing the inflationary peak reached, and in some cases exceeded. The words coming from the exponents of the main global central banks warn us that monetary tightening is not over yet, but the next stages will be slightly less bloody than the previous ones. Between steady prices and rising interest rates, the economic cycle has rapidly passed from a phase of decisive expansion to one of slowdown, so much so that the latest forecasts give 2022 closing with a GDP of +3.4% and 2023 reaching a +2.2%.

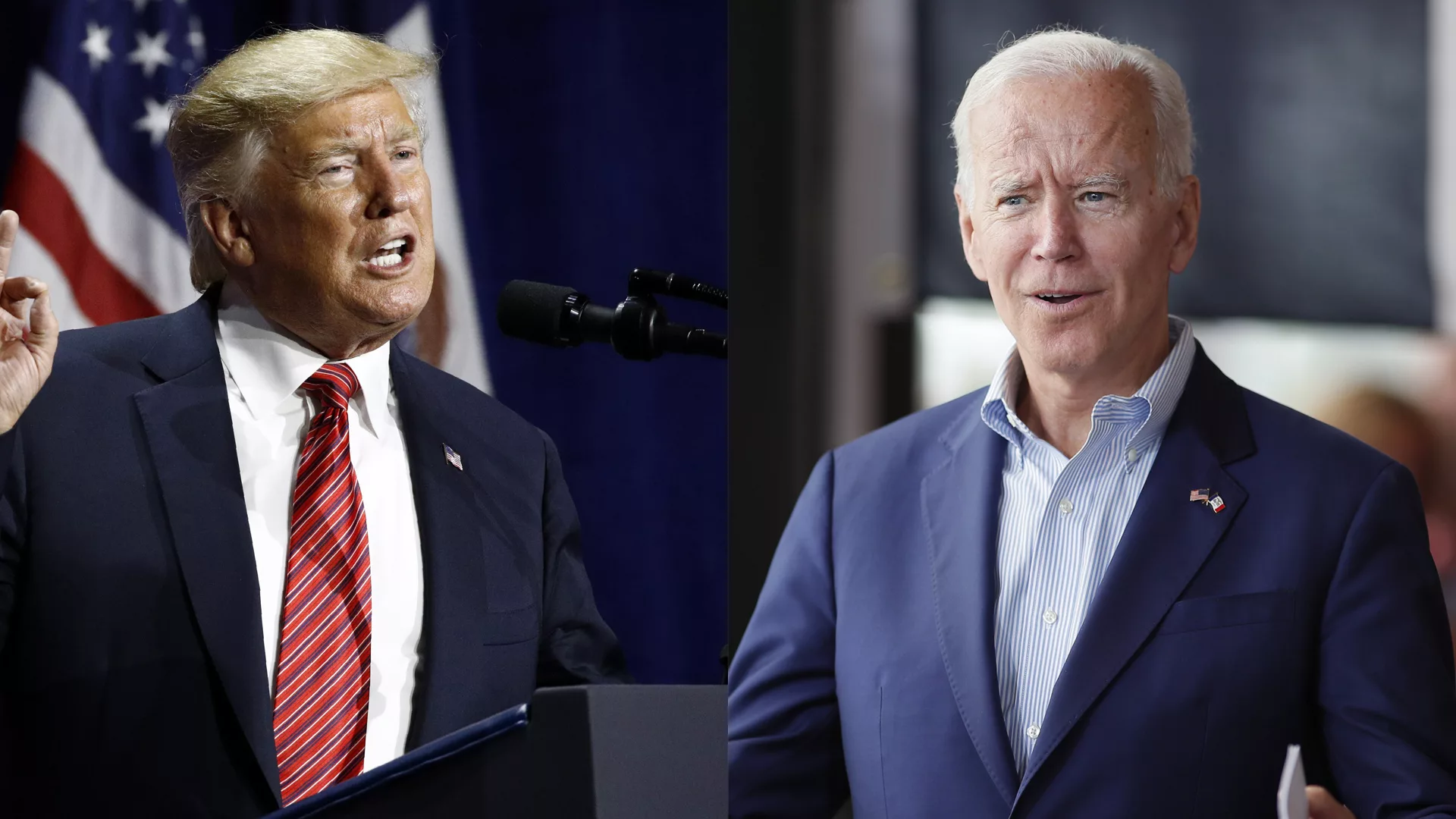

Nevertheless, 2022 will sadly also go down in history as the year of the outbreak of the Russia-Ukraine War, which from an economic point of view meant an increase in the prices of raw materials and above all chaos on the energy price front. The flame of hope ignited by the joint declaration of Biden and Macron – a peace conference held on December 13 in Paris – is all that one can hold onto as hope for a ceasefire. The certainty is that the economic consequences (sanctions, damages, new equilibriums to be found) will remain for a long time to weigh, above all, on the Eurozone economy.

With all this burden, we will enter 2023, and the outlook for this new year can only be heavily affected by it. So, the first feature that analysts seem to underline is that of a double speed: the first part of 2023 in line with what has been experienced in recent months (rising rates, sustained inflation, slowing economy); the second half of the year which could see a clear improvement in the scenario or – worst case scenario – a further slowdown.

Precisely for this reason, the first reports – such as that of Amundi – suggest to circle in red some elements, real turning points for the new year. Among them is the famous FED pivot. Knowing how far rates will go is no trivial matter. If they stopped at around 5%, the hypothesis of a soft landing would be in full sail, if they reached 6%, things would get complicated, not excluding a recessionary phase, and also a rather severe one. For the Eurozone, in addition to the interest rate factor, the fourth quarter of next year will be crucial, the moment in which we will begin to look at gas stocks in the first year of independence from Russian sources. An element that could push gas prices upwards as early as the summer, causing many headaches for governments and the central bank.

In all of this, the behaviour of the financial markets could be very nervous, especially on the equity front. In fact, one thing on which analysts seem to agree is that the bond market is once again attractive and its recovery in the coming months appears plausible (provided that quality and moderate duration are chosen). For shares, however, the 2023 outlook will depend on those turning points mentioned above and which could transform the current recovery of the lists from a simple bear market rally to something more structured.

Featured image by: Middle Market Growth