With the impending possibility of the United States breaching its debt ceiling, the “indisputable” stability of its financial and fiscal institutions is once again questioned. The ceiling, which was introduced in 1917, has since been raised a staggering 78 times and needs to be raised again if the nation wants to stay economically viable. The current debt limit is set at $31.4 trillion which was reached in January but continued to finance the government’s expenditures through extraordinary measures implemented.

According to Danny Blanchflower, an economics professor and former interest rate setter at the Bank of England, the consequences of the USA’s debt default would be a “million times worse” than the financial crisis of 2008. Despite it never happening in history, some fear the worst. JP Morgan is holding weekly meetings in order to prepare for the contingency amidst a general feeling of insecurity and skepticism regarding the government’s ability to handle the issue. The President of the Federal Reserve Bank of Minneapolis, Neel Kashkari, has told CNN that he believes the Fed does not “have the ability to protect the US economy against the downside of a default.” The heads of state are treading on thin ice, with the projected date for the nation’s bankruptcy set at June 5th according to Treasury Secretary Janet Yellen.

Economically, the consequences of the default cannot be overstated. Moody’s Analytics predicts an immediate shrink in America’s economy of 1% and a rise in unemployment from 3.4% to 5% in the case the default does occur. Should it persist during the summer, the numbers would tell a much darker tale, with GDP projected to drop by 4.6% along with a further loss of 7.8 million jobs. The stock market would s ni lump by 45% if the debt ceiling is breached according to the Council of Economic Advisers, which would imply a loss of $10 trillion worth of household wealth. Goldman Sachs has predicted that a breach of the debt ceiling would instantly shut down ten percent of the country’s economic activity. Coupled with all the discrete numerical consequences, a list of credit downgrades would also strike the United States, leading to a chain reaction in many financial institutions in the country. Mortgage prices would increase for example, and confidence in banks would essentially evaporate.

The deep recession caused by the breach would send ripples through financial markets worldwide, impacting trade everywhere. The dollar would decline, sparking massive volatility in foreign exchange markets and increasing the price of oil and other commodities. Exporters from the US could potentially benefit from the increased foreign demand caused by the depreciation of the dollar, but this would be canceled out by increased interest rates, detrimental to borrowing costs. Some developing countries would subsequently be forced to follow the path of the United States due to dependence on the dollar and would acquire vast amounts of debt themselves. With enough escalation, the entire world could plunge into a large-scale recession.

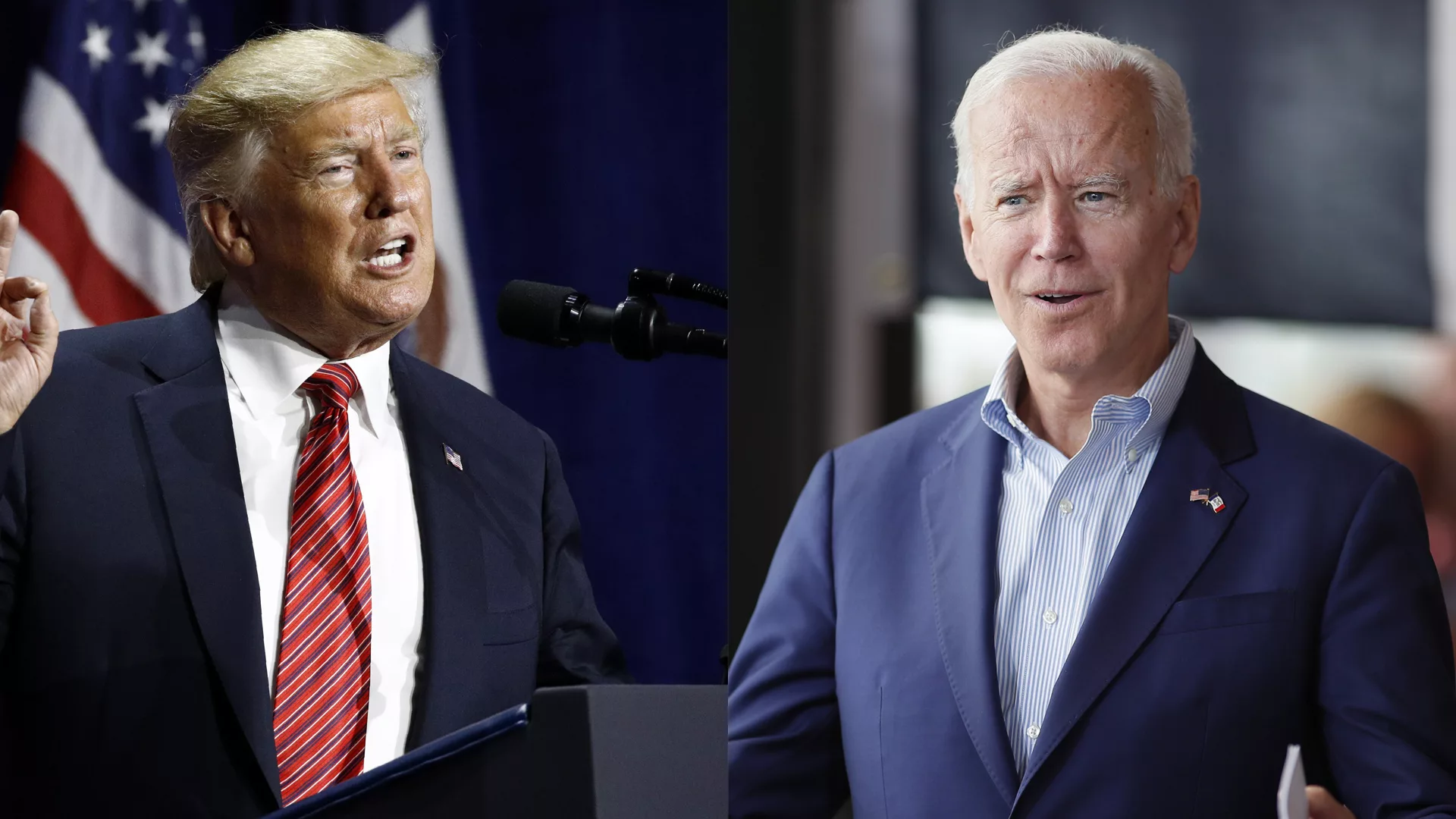

Plenty of solutions and remedies have been suggested, but President Biden remains determined to simply raise the debt ceiling once again. The Republican Party is opposed to solely this act, insisting on a $4.8 trillion budget cut which was voted for in April. Biden has rejected the possibility, insisting the debt ceiling ought to be increased without any other implications. He has instead suggested a tax increase on the wealthy – strongly opposed by the Republicans – which if implemented would decrease the deficit by nearly $3 trillion over the course of a decade. The two parties are in the process of working out a deal over raising the ceiling and both sides have expressed optimism regarding reaching an agreement. Simultaneously, the issue of increasing work requirements for welfare recipients is being negotiated and a consensus on both issues needs to be reached as soon as possible.

The Federal Reserve and The Treasury have constructed their own plan of action, known as “payment prioritization”. It would entail paying interest on bonds and cutting their commitment to some expenditures with the aim of stabilizing the debt atmosphere throughout the nation. They plan on handling defaulted securities like normal ones, accepting them as collateral for central bank loans. In doing so, the debt would be replaced with “good” debt, restoring faith in the government regarding the payment of defaulted securities simply with a slight delay. Support from the politicians would be required in order for this plan to succeed which would be more likely to come if the two parties came to an agreement regarding the entire issue.

The chain reaction that would stem from the debt default would encompass most of the world’s economic activity and could invite long-lasting consequences. Banks and consumers everywhere would feel the impact of the crisis, and markets and trade systems all around the globe would suffer. If the United States wants to prevent an economic disaster that would affect the entire world, it requires the utmost cooperation and commitment to action before it is too late.