The most important question among all questions regarding financial markets right now is this basic one: “when will things start to change?” The items in question are three: inflation, economic growth, and geopolitical tensions. The audience of international investors is debating the possible and probable trajectories of these three parameters, and the future performance of the financial markets depends on them.

Detecting the signs of a change means recognizing a recovery in stock and bond prices in the bud. Rob Arnott, the founder of Research Affiliates, argues that the fund has not yet been touched and that investors should wait until that point is reached before starting to buy. Interviewed by the WSJ, Arnott takes the case of the S&P 500. Looking at an indicator such as the Shiller P / E, as Arnott observes, we can see how the prices of the shares that make up the New York list are still high compared to the levels of the 2008 crisis, a sign that not all the power of the bearish hurricane has yet been discharged to the ground. Currently, the level of the CAPE ratio is 27.42, against a historical average (calculated from 1872 to today) of 16.80. A statistical interpretation, based on linear regression, would lead us to conclude that, over 10 years, the real value (corrected for inflation) of the US stock market should fall by about 16% from current levels. In other words, the CAPE would be telling us that we should expect a negative price trend of the S&P500 between now and the next few years.

Yet, there is a certain frenzy on the market. Things – it is the dominant sentiment on the financial markets – must change at some point. Starting with inflation. Nancy Davis, of Quadratic Capital Management LLC, summed up the situation very clearly: While the Fed has eliminated the word “transitory” in reference to inflation from its vocabulary, investors are still thinking about this term when looking at the cost of living data. The idea that everything can vanish in a short time, turning the clock back to the time of low rates and anaemic inflation, is a dangerous ally of the bear market.

There are those who see the cooling of the economy as a valid reason to think that prices will also cool with it. A discourse that could be correct in the US case (but there would still be discussion on the speed of cooling), which does not seem fitting on the European front (Lagarde’s words in this sense are quite explicit). To stop the inflation phenomenon quickly, a rather severe recession would probably be needed, but even this hypothesis is not among those that investors are considering.

In this scenario, a negative sentiment from investors is more than understandable, as they have less certainty about their investment choices. In this regard, two elements seem to emerge: the first is that it will be increasingly essential to make tactical changes according to macroeconomic trends; the second is that the investment time horizon is fundamental. With this in mind, according to some experts, if the horizon is 12 months, the advice is that in the phases of a rise in the stock market, it is necessary to sell and reduce equity positions. Why? The high probability of a U.S. recession with the Federal Reserve still not ready for rates. If, on the other hand, the horizon is 24 months, the fall in the indices can offer buying opportunities, without exaggerating and with careful selection of sectors and stocks. The reasons, in this case, are to be found in the fact that in September 2024, the economy should be back around to the 2% target, the recovery and the upcoming American presidential elections: a context that should allow the stock market and that of fixed income to be at higher levels than the current ones.

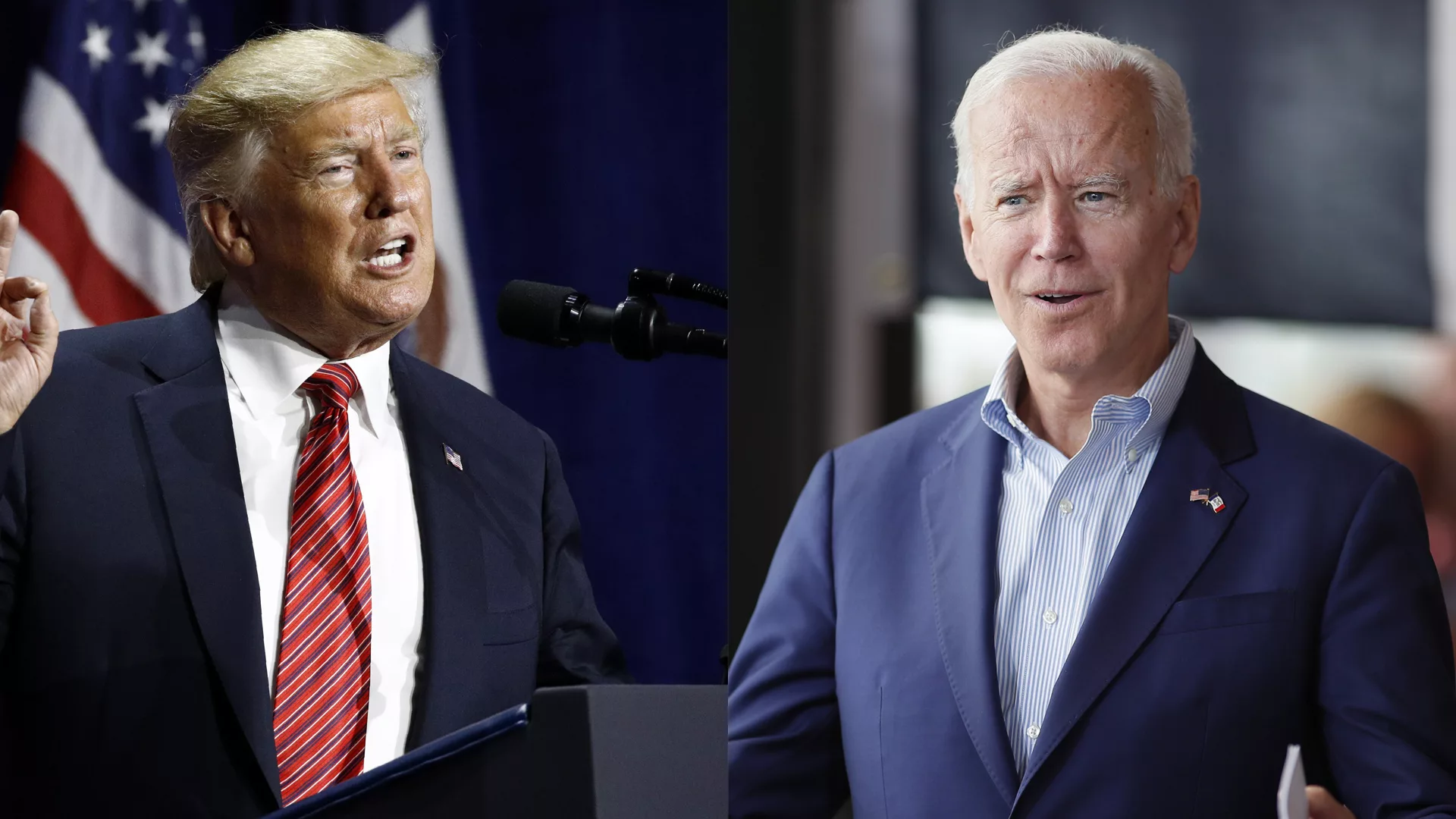

Featured image by: Desjardins